Group Lending

As a microfinance organization, Chaitanya’s primary aim is to empower women from rural backgrounds and provide them the financial support needed to start business ventures and contribute to the economy. Chaitanya empowers more than 1 million women customers and aims to create a deeper impact in society by strengthening the rural women population of the country.

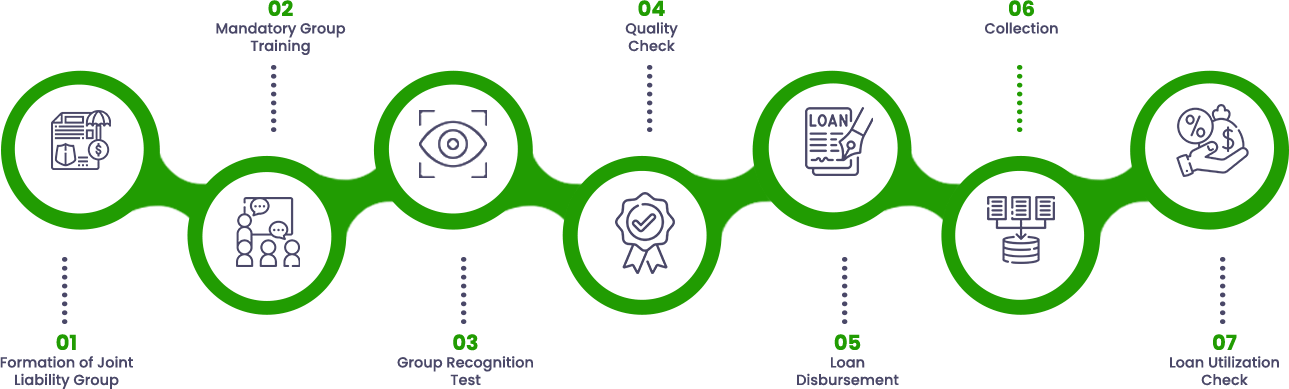

Our Process

Client Selection & Approach for gradation of risk:

The decision to give a loan is assessed on a case to case basis, based on multiple parameters such as borrower profile and repayment capacity, borrower’s other financial commitments, past repayment track record if any, tenure of the loan, occupation and stability of income, geography (location) of the borrower, end-use of the loan, etc. Such information is collected based on borrower inputs and field inspection by the company officials.

Women Empowerment

As a microfinance organization, Chaitanya’s primary aim is to empower women from rural backgrounds and provide them the financial support needed to start business ventures and contribute to the economy. Chaitanya empowers more than 1 million women customers and aims to create a deeper impact in society by strengthening the rural women population of the country.